CFD trading

WHAT IS CFD TRADING?

The question “what is CFD trading?” is the most frequent one among beginner traders, who are just starting out in online trading.

CFD is a versatile investment instrument and it is traded by the same method as currencies are done.

CFD or Contract for difference is an agreement between two parties, buyer and seller. You can use CFDs to trade and speculate on the price movements of

thousands of financial markets regardless of whether prices are rising or falling. You can go long (buy) a CFD market, and profit from prices as they rise or

go short (sell) and profit from falling prices. CFDs give you a great deal of trading flexibility, allowing you to profit from financial markets regardless of price direction.

How does CFD trading work?

When you open a CFD position you select the amount of CFDs you would like to trade and your profit will rise in line with each point the market moves in your favour.

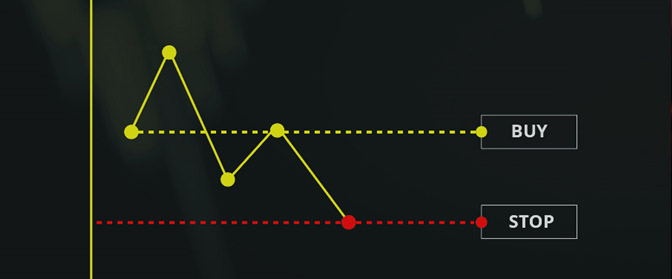

If you think the price of your chosen market will go up, you click buy and your profits will rise in line with any increase in that price.

Leveraged Trading

Margin trading allows to take a higher position volume in the market by a small sum of the invested capital. When the market moves according to your expected direction the profit increases by the provided leverage, since you had deposited only a part of the total contract value but the profit will be made from the change of the total value. Conversely, in margin trading losses may also increase in case the market goes against your expected direction. That is why it is important to be careful when trading with a leverage: risk management becomes highly important.

Day Trading

Day trading is defined as the process of buying and selling various assets within the same trading day. This means that a trader or an investor is free to make as many trading transactions as he would like within a single day. As leveraged trading enables opening bigger positions with limited deposit amount, trading CFD is possible even in cases of slight fluctuations of the asset value during one day.

Trading Stocks, Commodities, Indices and Currencies

A CFD (Contract for Difference) is a universal trading instrument, which has gained much popularity in the last years. With the help of CFDs, it has become possible to trade on the price movements of various financial instruments, without the need to possess them physically. Nowadays, CFDs allow to trade not only stocks but also major indices, currencies and commodities.

CFD trading is a margined product

This means you trade by paying just a small fraction of the total value of the contract.

Remember that with leveraged trading, there is a potential for your losses to exceed deposits.

In other words you can put up a small amount of money to control a much larger amount potentially magnifying your return on investment.

Remember, however, that your losses will be magnified as well, so you should manage your risk accordingly.

Which CFD markets can I trade on?

City Index offers a choice of over 5,000 CFD markets, including:

- Indices such as the UK 100, Wall St and Germany 30

- FX such as GBP/USD, GBP/EUR and JPY/USD currency pairs

- Shares such as Rio Tinto, Amazon and General Electric

- Commodities such as oil, gold and cocoa

- Other markets including bonds, interest rates and options

CFDs enable traders to take a position on a product based on the amount of movement in its value, instead of needing to buy the product and subsequently selling it or vice versa.

Trading CFDs gives you the ability to use leverage, which lets traders open positions which are significantly larger than the amount of money put down; although traders should remember that increasing one’s leverage also increases one’s risk.

Spreads will vary based on market conditions, including volatility, available liquidity, and other factors. “Typical” spreads for noted pairs represent the median and are tracked during a specified time frame.

Trade on leverage

Get full market exposure for only a fraction of an asset’s price. Yet any profit or loss you make will be based on its full value.

Trade commodities

Access to a full range of commodities including gold, silver and oil with Barclays CFDs

Go long and short

Trade even in volatile markets. If you think prices will rise, you go long and buy. If you think they’ll fall you go short and sell

No Stamp Duty

Save up to 0.5% on the value of each trade. Tax laws may change in the future and depend on your individual circumstances.